今天要學習虛擬貨幣的現貨和期貨交易,這就像農業中的現金交易和期約交易。爸爸賣菜有兩種方式:一是現場賣給菜販(現貨),二是提前和餐廳簽約未來交貨(期貨)。兩種方式各有優缺點,讓我們來深入了解!

現貨交易就像在市場上直接買賣真實的貨物:

class SpotTrading:

"""現貨交易系統"""

def __init__(self, initial_balance=10000):

self.balance = initial_balance

self.holdings = {} # {symbol: quantity}

self.transaction_history = []

def buy_spot(self, symbol, quantity, price):

"""買入現貨"""

total_cost = quantity * price

fee = total_cost * 0.001 # 0.1% 手續費

if self.balance >= total_cost + fee:

self.balance -= (total_cost + fee)

if symbol in self.holdings:

self.holdings[symbol] += quantity

else:

self.holdings[symbol] = quantity

self.transaction_history.append({

'type': 'buy',

'symbol': symbol,

'quantity': quantity,

'price': price,

'fee': fee,

'timestamp': 'now'

})

return True, f"成功買入 {quantity} {symbol}"

else:

return False, "餘額不足"

def sell_spot(self, symbol, quantity, price):

"""賣出現貨"""

if symbol in self.holdings and self.holdings[symbol] >= quantity:

total_value = quantity * price

fee = total_value * 0.001

net_receive = total_value - fee

self.balance += net_receive

self.holdings[symbol] -= quantity

if self.holdings[symbol] == 0:

del self.holdings[symbol]

self.transaction_history.append({

'type': 'sell',

'symbol': symbol,

'quantity': quantity,

'price': price,

'fee': fee,

'timestamp': 'now'

})

return True, f"成功賣出 {quantity} {symbol}"

else:

return False, "持有量不足"

def get_portfolio_value(self, current_prices):

"""計算投資組合總值"""

portfolio_value = self.balance

for symbol, quantity in self.holdings.items():

if symbol in current_prices:

portfolio_value += quantity * current_prices[symbol]

return portfolio_value

def calculate_unrealized_pnl(self, current_prices):

"""計算未實現損益"""

unrealized_pnl = {}

total_unrealized = 0

for symbol, quantity in self.holdings.items():

if symbol in current_prices:

# 計算平均成本

buy_transactions = [t for t in self.transaction_history

if t['symbol'] == symbol and t['type'] == 'buy']

if buy_transactions:

total_cost = sum(t['quantity'] * t['price'] for t in buy_transactions)

total_quantity = sum(t['quantity'] for t in buy_transactions)

avg_cost = total_cost / total_quantity

current_value = quantity * current_prices[symbol]

cost_basis = quantity * avg_cost

pnl = current_value - cost_basis

unrealized_pnl[symbol] = {

'quantity': quantity,

'avg_cost': avg_cost,

'current_price': current_prices[symbol],

'unrealized_pnl': pnl,

'pnl_percentage': pnl / cost_basis if cost_basis > 0 else 0

}

total_unrealized += pnl

return unrealized_pnl, total_unrealized

# 使用示例

spot_trader = SpotTrading()

# 買入 BTC

spot_trader.buy_spot('BTC', 0.1, 50000)

spot_trader.buy_spot('ETH', 2, 3000)

# 查看投資組合

current_prices = {'BTC': 55000, 'ETH': 3200}

portfolio_value = spot_trader.get_portfolio_value(current_prices)

unrealized_pnl, total_pnl = spot_trader.calculate_unrealized_pnl(current_prices)

print(f"投資組合總值: ${portfolio_value:.2f}")

print(f"總未實現損益: ${total_pnl:.2f}")

期貨是標準化的未來交易合約:

class FuturesTrading:

"""期貨交易系統"""

def __init__(self, initial_balance=10000):

self.balance = initial_balance

self.positions = {} # {symbol: {'side': 'long/short', 'size': quantity, 'entry_price': price}}

self.used_margin = 0

self.transaction_history = []

def calculate_required_margin(self, symbol, size, price, leverage=10):

"""計算所需保證金"""

notional_value = size * price

required_margin = notional_value / leverage

return required_margin

def open_position(self, symbol, side, size, price, leverage=10):

"""開倉"""

required_margin = self.calculate_required_margin(symbol, size, price, leverage)

fee = size * price * 0.0004 # 0.04% 手續費

available_balance = self.balance - self.used_margin

if available_balance >= required_margin + fee:

# 更新保證金使用

self.used_margin += required_margin

self.balance -= fee

# 記錄部位

position_key = f"{symbol}_{side}"

if position_key in self.positions:

# 加倉

old_pos = self.positions[position_key]

total_size = old_pos['size'] + size

weighted_price = (old_pos['size'] * old_pos['entry_price'] +

size * price) / total_size

self.positions[position_key] = {

'side': side,

'size': total_size,

'entry_price': weighted_price,

'leverage': leverage,

'margin': old_pos['margin'] + required_margin

}

else:

# 新倉

self.positions[position_key] = {

'side': side,

'size': size,

'entry_price': price,

'leverage': leverage,

'margin': required_margin

}

self.transaction_history.append({

'type': 'open',

'symbol': symbol,

'side': side,

'size': size,

'price': price,

'leverage': leverage,

'margin': required_margin,

'fee': fee,

'timestamp': 'now'

})

return True, f"成功開倉 {side} {size} {symbol}"

else:

return False, "保證金不足"

def close_position(self, symbol, side, size, price):

"""平倉"""

position_key = f"{symbol}_{side}"

if position_key not in self.positions:

return False, "無對應部位"

position = self.positions[position_key]

if position['size'] < size:

return False, "平倉數量超過持倉"

# 計算損益

if side == 'long':

pnl = size * (price - position['entry_price'])

else: # short

pnl = size * (position['entry_price'] - price)

# 計算手續費

fee = size * price * 0.0004

net_pnl = pnl - fee

# 釋放保證金

margin_released = (size / position['size']) * position['margin']

self.used_margin -= margin_released

# 更新餘額

self.balance += net_pnl + margin_released

# 更新部位

if position['size'] == size:

# 完全平倉

del self.positions[position_key]

else:

# 部分平倉

remaining_ratio = (position['size'] - size) / position['size']

self.positions[position_key]['size'] -= size

self.positions[position_key]['margin'] *= remaining_ratio

self.transaction_history.append({

'type': 'close',

'symbol': symbol,

'side': side,

'size': size,

'price': price,

'pnl': pnl,

'fee': fee,

'net_pnl': net_pnl,

'timestamp': 'now'

})

return True, f"平倉成功,淨損益: ${net_pnl:.2f}"

def calculate_unrealized_pnl(self, current_prices):

"""計算未實現損益"""

total_unrealized_pnl = 0

position_details = {}

for position_key, position in self.positions.items():

symbol = position_key.split('_')[0]

side = position['side']

if symbol in current_prices:

current_price = current_prices[symbol]

entry_price = position['entry_price']

size = position['size']

if side == 'long':

unrealized_pnl = size * (current_price - entry_price)

else: # short

unrealized_pnl = size * (entry_price - current_price)

total_unrealized_pnl += unrealized_pnl

position_details[position_key] = {

'symbol': symbol,

'side': side,

'size': size,

'entry_price': entry_price,

'current_price': current_price,

'unrealized_pnl': unrealized_pnl,

'margin': position['margin']

}

return position_details, total_unrealized_pnl

def check_margin_call(self, current_prices, maintenance_margin_ratio=0.5):

"""檢查保證金追繳"""

_, unrealized_pnl = self.calculate_unrealized_pnl(current_prices)

current_equity = self.balance + unrealized_pnl

required_maintenance = self.used_margin * maintenance_margin_ratio

if current_equity < required_maintenance:

return True, f"保證金追繳警告!當前權益: ${current_equity:.2f}, 需要: ${required_maintenance:.2f}"

return False, "保證金充足"

# 使用示例

futures_trader = FuturesTrading()

# 開多倉 BTC

success, msg = futures_trader.open_position('BTC', 'long', 1, 50000, leverage=10)

print(msg)

# 開空倉 ETH

futures_trader.open_position('ETH', 'short', 5, 3000, leverage=5)

# 檢查未實現損益

current_prices = {'BTC': 52000, 'ETH': 2900}

positions, total_pnl = futures_trader.calculate_unrealized_pnl(current_prices)

print(f"總未實現損益: ${total_pnl:.2f}")

# 檢查保證金狀況

margin_call, msg = futures_trader.check_margin_call(current_prices)

print(f"保證金狀況: {msg}")

class TradingStrategyComparison:

"""交易策略適用性比較"""

def __init__(self):

self.strategy_suitability = {

'buy_and_hold': {

'spot': 10, # 最適合現貨

'futures': 3, # 不適合期貨(有到期日)

'reason': '長期持有策略需要避免展倉成本'

},

'swing_trading': {

'spot': 7, # 適合現貨

'futures': 8, # 更適合期貨

'reason': '中期交易可利用期貨的槓桿優勢'

},

'day_trading': {

'spot': 5, # 一般適合

'futures': 9, # 非常適合

'reason': '日內交易適合利用期貨的高流動性和槓桿'

},

'scalping': {

'spot': 6, # 勉強適合

'futures': 9, # 非常適合

'reason': '剝頭皮需要高頻交易和槓桿放大微利'

},

'arbitrage': {

'spot': 8, # 適合

'futures': 9, # 非常適合

'reason': '套利策略需要靈活的做空能力'

},

'hedging': {

'spot': 5, # 有限適用

'futures': 10, # 完美適合

'reason': '對沖需要衍生品工具'

}

}

def get_recommendation(self, strategy, capital_size, risk_tolerance):

"""獲取策略建議"""

strategy_info = self.strategy_suitability.get(strategy, {})

recommendation = {

'strategy': strategy,

'spot_score': strategy_info.get('spot', 0),

'futures_score': strategy_info.get('futures', 0),

'reason': strategy_info.get('reason', ''),

}

# 根據資金規模調整建議

if capital_size < 10000:

recommendation['note'] = '小資金建議先從現貨開始學習'

elif capital_size > 100000:

recommendation['note'] = '大資金可考慮期貨提高資金效率'

# 根據風險承受度調整

if risk_tolerance == 'low':

recommendation['futures_score'] *= 0.5

elif risk_tolerance == 'high':

recommendation['futures_score'] *= 1.2

return recommendation

# 策略建議示例

comparator = TradingStrategyComparison()

strategies = ['buy_and_hold', 'day_trading', 'arbitrage']

for strategy in strategies:

rec = comparator.get_recommendation(strategy, capital_size=50000, risk_tolerance='medium')

print(f"\n{strategy}:")

print(f"現貨適合度: {rec['spot_score']}/10")

print(f"期貨適合度: {rec['futures_score']:.1f}/10")

print(f"原因: {rec['reason']}")

class BasisAnalysis:

"""基差分析工具"""

def __init__(self):

self.basis_history = []

def calculate_basis(self, spot_price, futures_price, days_to_expiry):

"""計算基差和年化基差率"""

basis = futures_price - spot_price

basis_rate = basis / spot_price

annualized_basis_rate = basis_rate * (365 / days_to_expiry)

return {

'basis': basis,

'basis_rate': basis_rate,

'annualized_basis_rate': annualized_basis_rate,

'contango': basis > 0, # 正價差(期貨>現貨)

'backwardation': basis < 0 # 逆價差(期貨<現貨)

}

def identify_arbitrage_opportunity(self, spot_price, futures_price,

days_to_expiry, risk_free_rate=0.05):

"""識別套利機會"""

basis_info = self.calculate_basis(spot_price, futures_price, days_to_expiry)

# 理論期貨價格(考慮無風險利率)

theoretical_futures = spot_price * (1 + risk_free_rate * days_to_expiry / 365)

# 套利機會判斷

if futures_price > theoretical_futures * 1.01: # 期貨溢價>1%

return {

'opportunity': True,

'strategy': 'sell_futures_buy_spot',

'expected_profit': futures_price - theoretical_futures,

'profit_rate': (futures_price - theoretical_futures) / spot_price,

'action': '賣期貨,買現貨'

}

elif futures_price < theoretical_futures * 0.99: # 期貨折價>1%

return {

'opportunity': True,

'strategy': 'buy_futures_sell_spot',

'expected_profit': theoretical_futures - futures_price,

'profit_rate': (theoretical_futures - futures_price) / spot_price,

'action': '買期貨,賣現貨'

}

else:

return {

'opportunity': False,

'reason': '基差在合理範圍內'

}

# 基差分析示例

basis_analyzer = BasisAnalysis()

# 分析套利機會

spot_price = 50000

futures_price = 50800

days_to_expiry = 30

opportunity = basis_analyzer.identify_arbitrage_opportunity(

spot_price, futures_price, days_to_expiry

)

if opportunity['opportunity']:

print(f"發現套利機會!")

print(f"策略: {opportunity['action']}")

print(f"預期利潤: ${opportunity['expected_profit']:.2f}")

print(f"利潤率: {opportunity['profit_rate']:.2%}")

else:

print(f"無套利機會: {opportunity['reason']}")

class RiskManagementComparison:

"""現貨與期貨風險管理比較"""

def __init__(self):

self.spot_risks = {

'market_risk': '價格下跌風險,最大損失100%',

'liquidity_risk': '流動性不足時難以快速出場',

'custody_risk': '錢包安全、交易所風險',

'regulatory_risk': '監管變化影響'

}

self.futures_risks = {

'market_risk': '槓桿放大損失,可能超過本金',

'liquidity_risk': '保證金追繳、強制平倉',

'basis_risk': '現貨期貨價差變動風險',

'rollover_risk': '展倉成本和時機風險',

'counterparty_risk': '交易對手違約風險'

}

def calculate_risk_metrics(self, position_type, position_size, entry_price,

current_price, leverage=1):

"""計算風險指標"""

if position_type == 'spot':

unrealized_pnl = position_size * (current_price - entry_price)

max_loss = position_size * entry_price # 最大損失為本金

margin_requirement = position_size * entry_price

else: # futures

if leverage > 1:

notional_value = position_size * entry_price

margin_requirement = notional_value / leverage

unrealized_pnl = position_size * (current_price - entry_price)

# 期貨最大損失可能超過保證金

max_loss = float('inf') # 理論上無限

else:

return self.calculate_risk_metrics('spot', position_size,

entry_price, current_price, 1)

return {

'unrealized_pnl': unrealized_pnl,

'pnl_percentage': unrealized_pnl / (position_size * entry_price),

'margin_requirement': margin_requirement,

'max_loss': max_loss,

'leverage': leverage,

'position_type': position_type

}

def recommend_stop_loss(self, position_type, leverage=1, risk_tolerance='medium'):

"""建議停損設定"""

if position_type == 'spot':

if risk_tolerance == 'low':

return 0.05 # 5%

elif risk_tolerance == 'medium':

return 0.10 # 10%

else:

return 0.15 # 15%

else: # futures

base_stop = self.recommend_stop_loss('spot', 1, risk_tolerance)

adjusted_stop = base_stop / leverage # 槓桿越高,停損越嚴格

return max(adjusted_stop, 0.02) # 最少2%

# 風險比較示例

risk_manager = RiskManagementComparison()

# 比較現貨和期貨風險

spot_metrics = risk_manager.calculate_risk_metrics(

'spot', 1, 50000, 48000

)

futures_metrics = risk_manager.calculate_risk_metrics(

'futures', 1, 50000, 48000, leverage=10

)

print("現貨交易風險:")

print(f"未實現損益: ${spot_metrics['unrealized_pnl']:.2f}")

print(f"損益百分比: {spot_metrics['pnl_percentage']:.2%}")

print(f"保證金需求: ${spot_metrics['margin_requirement']:.2f}")

print("\n期貨交易風險:")

print(f"未實現損益: ${futures_metrics['unrealized_pnl']:.2f}")

print(f"損益百分比: {futures_metrics['pnl_percentage']:.2%}")

print(f"保證金需求: ${futures_metrics['margin_requirement']:.2f}")

# 停損建議

spot_stop = risk_manager.recommend_stop_loss('spot', risk_tolerance='medium')

futures_stop = risk_manager.recommend_stop_loss('futures', leverage=10, risk_tolerance='medium')

print(f"\n停損建議:")

print(f"現貨停損: {spot_stop:.1%}")

print(f"期貨停損: {futures_stop:.1%}")

今天我們深入比較了虛擬貨幣的現貨和期貨交易,就像比較現金買賣和期約交易的差異。重要要點:

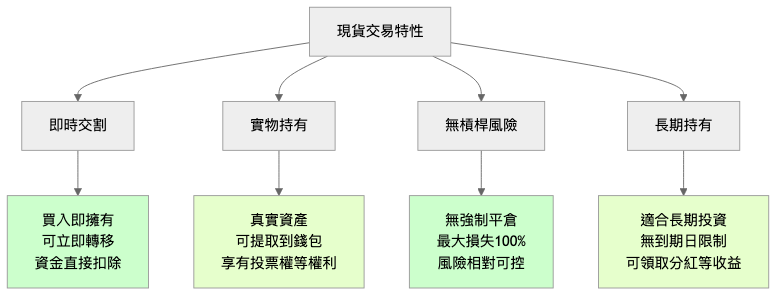

現貨交易特點:

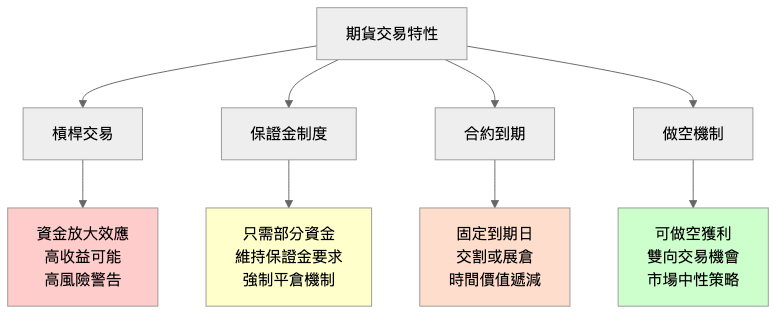

期貨交易特點:

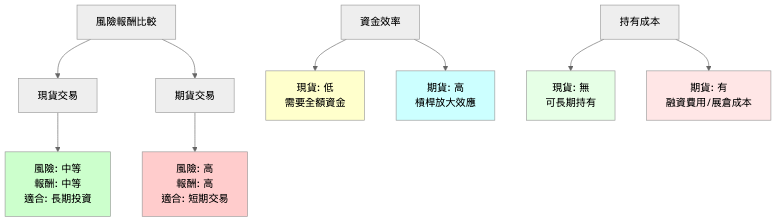

選擇建議:

風險控制重點:

明天我們將學習合約中的槓桿與資金費率,進一步了解期貨交易的細節!

下一篇:Day 21 - 合約中的槓桿與現金費率